Estate Planning Attorney - Truths

Estate Planning Attorney - Truths

Blog Article

Some Of Estate Planning Attorney

Table of ContentsThe Ultimate Guide To Estate Planning AttorneyAbout Estate Planning AttorneyThe Main Principles Of Estate Planning Attorney 7 Simple Techniques For Estate Planning Attorney

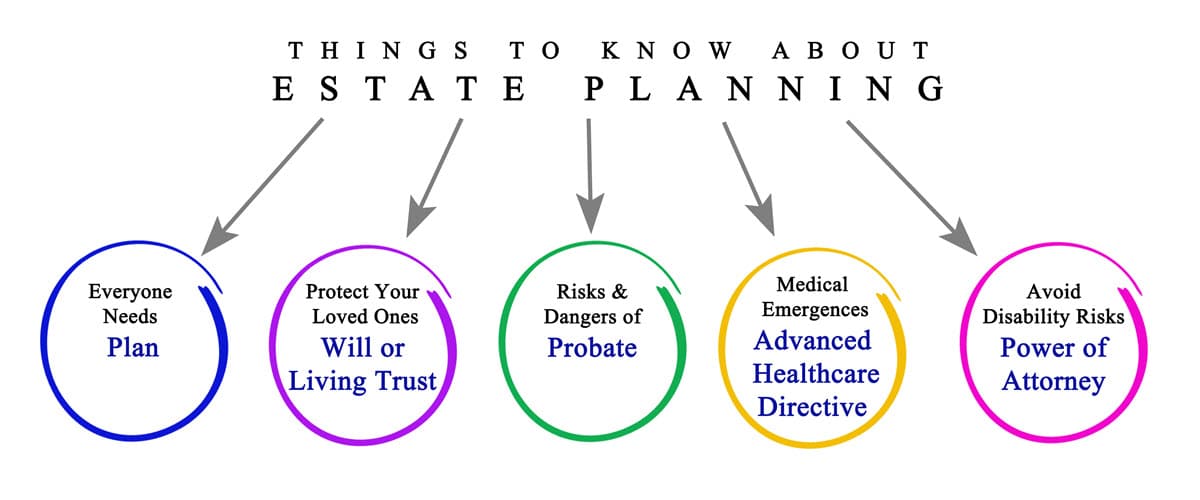

Estate preparation is an activity strategy you can use to identify what takes place to your properties and obligations while you're to life and after you pass away. A will, on the various other hand, is a lawful document that describes exactly how properties are dispersed, that deals with children and pet dogs, and any various other wishes after you pass away.

The administrator also needs to pay off any type of taxes and financial obligation owed by the deceased from the estate. Creditors normally have a limited amount of time from the day they were notified of the testator's fatality to make cases against the estate for money owed to them. Cases that are declined by the administrator can be taken to court where a probate judge will certainly have the final say as to whether the claim stands.

Getting The Estate Planning Attorney To Work

After the supply of the estate has actually been taken, the worth of possessions determined, and tax obligations and debt settled, the administrator will certainly after that look for permission from the court to distribute whatever is left of the estate to the recipients. Any type of inheritance tax that are pending will come due within 9 months of the day of death.

Each individual locations their properties in the count on and names a person other than their spouse as the beneficiary., to sustain grandchildrens' education.

7 Easy Facts About Estate Planning Attorney Explained

Estate coordinators can collaborate with the contributor in order to minimize taxed income as an outcome of those payments or formulate strategies that make the most of the result of those contributions. This is another method that can be utilized to restrict fatality taxes. It entails an individual locking in the present worth, and therefore tax responsibility, of their residential property, while attributing the value of future growth of that capital to one more individual. This technique involves cold the worth of a property at its worth on the date of transfer. Accordingly, the quantity of prospective capital gain at death is likewise frozen, allowing the estate planner to estimate their possible tax obligation obligation upon fatality and far better prepare for the settlement of income taxes.

If enough insurance profits are offered and the plans are correctly structured, any kind of income tax obligation on the considered dispositions of properties following the fatality of an individual can be paid without considering the sale of properties. Proceeds from life insurance policy Click This Link that are received by the beneficiaries upon the death of the guaranteed are usually revenue tax-free.

Various other charges connected with estate preparation consist of the preparation of a will, which can be as reduced as a few hundred dollars if you use among the best online will makers. There are certain papers you'll require as part of the estate planning process - Estate Planning Attorney. A few of the most common ones consist of wills, powers of attorney (POAs), guardianship classifications, and living wills.

There is a misconception that estate planning is just for high-net-worth individuals. Estate planning makes it simpler for individuals to go to my site establish their dreams before and after they die.

Examine This Report about Estate Planning Attorney

You need to begin planning for your estate as quickly as you have any type of quantifiable property base. It's a recurring procedure: as life progresses, your estate plan must move to match your conditions, according to your new objectives. And keep at it. Refraining your estate preparation can create undue financial burdens to enjoyed ones.

Estate preparation is typically assumed of as a tool for the well-off. That isn't the case. It can be a beneficial means for you to handle your possessions and liabilities before and after you pass away. Estate preparation is also an excellent way for you to lay out prepare for the treatment of your small children and family pets and to detail your want your funeral and preferred charities.

Qualified applicants look at this website who pass the test will be officially licensed in August. If you're eligible to sit for the test from a previous application, you may file the brief application.

Report this page